Introduction

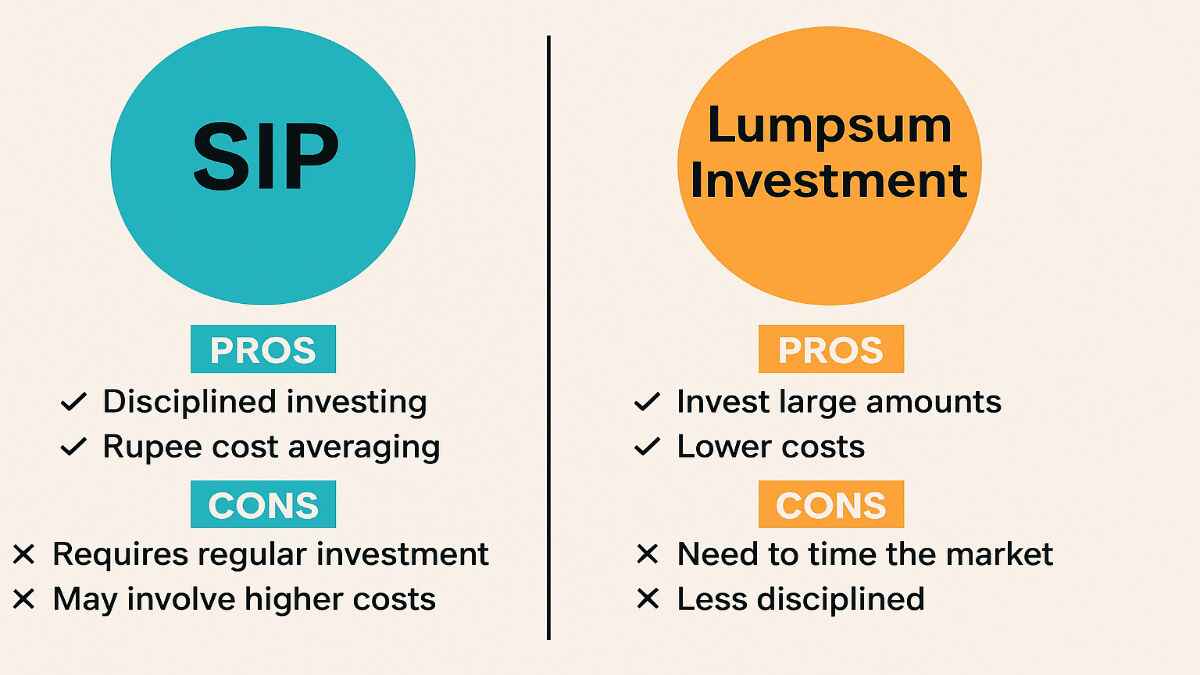

Investing is a powerful way to achieve financial goals, whether it’s saving for a dream home, funding your child’s education, or building a retirement corpus. In India, mutual funds have become a go-to investment option due to their diversification, professional management, and potential for higher returns compared to traditional savings like fixed deposits. When investing in mutual funds, two primary strategies stand out: Systematic Investment Plan (SIP) and Lumpsum Investment. Both approaches have unique advantages and drawbacks, making the choice between them a critical decision for investors.”SIP vs Lumpsum Investment: Pros & Cons”

Table of Contents

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where you commit to investing a fixed amount at regular intervals, typically monthly or quarterly. It’s like setting up a recurring deposit, where a small, fixed sum is automatically deducted from your bank account and invested in a chosen mutual fund scheme. SIPs are immensely popular in India because they allow investors to start with as little as Rs. 100 per month, making them accessible to everyone, from salaried professionals to students.

How Does SIP Work?

When you start an SIP, you select a mutual fund scheme and decide on an investment amount and frequency (e.g., Rs. 5,000 monthly). On the chosen date, the amount is deducted from your bank account and used to purchase units of the mutual fund at the prevailing Net Asset Value (NAV). The key feature of SIP is rupee cost averaging, which means you buy more units when the market is down and fewer when it’s up, reducing the average cost per unit over time.

For example, if you invest Rs. 5,000 monthly in a mutual fund:

- In Month 1, if the NAV is Rs. 50, you get 100 units.

- In Month 2, if the NAV drops to Rs. 40, you get 125 units.

- In Month 3, if the NAV rises to Rs. 60, you get 83.33 units.

Over time, this averages out your purchase price, mitigating the impact of market volatility.

Pros of SIP

- Discipline and Consistency

SIPs encourage regular saving and investing, fostering financial discipline. The automated deduction ensures you invest consistently, even during busy or financially tight months. This habit is crucial for long-term wealth creation. - Rupee Cost Averaging

By investing a fixed amount regularly, you buy more units when prices are low and fewer when prices are high. This reduces the risk of investing a large sum at a peak price, making SIPs ideal for volatile markets. - Low Entry Barrier

SIPs allow you to start with as little as Rs. 100 per month, making them accessible to beginners, young professionals, or those with limited surplus funds. This low entry point democratizes investing in India. - Flexibility

SIPs offer flexibility to pause, stop, or increase your investment amount based on your financial situation. For instance, if you face a financial crunch, you can pause your SIP without penalty in most cases. - Power of Compounding

Regular investments through SIP allow your money to grow exponentially over time due to compounding. The returns earned are reinvested, generating further returns, which can significantly boost your wealth over the long term. - Suitable for All Market Conditions

SIPs perform well in both bullish (rising) and bearish (falling) markets. In a falling market, you accumulate more units at lower prices, and in a rising market, your existing units appreciate in value. - Professional Management

Mutual funds are managed by professional fund managers, ensuring your money is invested in a diversified portfolio, reducing risk and enhancing returns. - Tax Benefits

Investing in Equity-Linked Savings Schemes (ELSS) through SIPs qualifies for tax deductions of up to Rs. 1.5 lakh per year under Section 80C of the Income Tax Act, making it a tax-efficient option.

Cons of SIP

- Long-Term Commitment

SIPs are most effective when maintained over a long period, typically 5–10 years or more. This long-term commitment may not suit investors seeking quick returns or those needing liquidity. - No Guarantee of High Returns

While SIPs reduce risk, they don’t guarantee high returns. The performance depends on the mutual fund scheme and market conditions. Poor fund selection can lead to suboptimal returns. - Less Effective in Consistently Rising Markets

In a bull market where prices rise steadily, a lumpsum investment at the start might yield higher returns than SIP, as you’d buy more units at lower prices initially. - Potential for Missed Payments

If you face financial constraints, you might miss SIP payments, which could disrupt your investment plan. However, most fund houses allow you to resume SIPs without penalties.

What is Lumpsum Investment?

A Lumpsum Investment involves investing a large amount of money in a mutual fund scheme in one go. For example, if you receive a bonus, inheritance, or proceeds from selling an asset, you might invest Rs. 1 lakh at once. This method is suitable for investors with significant capital and confidence in market timing.

How Does Lumpsum Work?

In a lumpsum investment, the entire amount is invested on a single day, and the number of units you receive depends on the NAV of the mutual fund on that day. For instance, if you invest Rs. 1 lakh when the NAV is Rs. 50, you get 2,000 units. Your returns depend on how the market performs after your investment. If the NAV rises to Rs. 60, your investment grows to Rs. 1.2 lakh, but if it falls to Rs. 40, it drops to Rs. 80,000.

Pros of Lumpsum

- Potential for Higher Returns

If you invest a lumpsum when the market is low, you can buy more units at a lower price, potentially leading to higher returns when the market rises. For example, investing during a market correction can yield significant gains. - Immediate Deployment

The entire amount is invested at once, allowing it to start earning returns immediately. This can be advantageous for short-term goals or when you want to capitalize on a market opportunity. - Suitability for Short-Term Goals

Lumpsum investments are often used for short-term financial goals, such as funding a vacation or a down payment, where timing is critical. - Simplicity

Lumpsum investments are straightforward—you invest once and monitor the performance. There’s no need for regular contributions or adjustments, unlike SIPs. - Adaptability to Market Conditions

Experienced investors can use lumpsum investments to take advantage of market lows, such as during economic downturns or corrections, to maximize returns.

Cons of Lumpsum

- Market Timing Risk

Lumpsum investments require you to time the market correctly. Investing at a market peak can lead to losses if the market declines soon after. This makes lumpsum riskier, especially for inexperienced investors. - Higher Initial Investment

Lumpsum requires a substantial amount upfront, typically Rs. 1,000 or more, depending on the fund. This high entry barrier makes it less accessible for small investors. - No Rupee Cost Averaging

Unlike SIP, lumpsum does not benefit from rupee cost averaging. If you invest at a high NAV and the market falls, you could face significant losses. - Higher Risk for Risk-Averse Investors

Lumpsum investments are riskier for those uncomfortable with market fluctuations. A single wrong timing decision can lead to substantial losses. - Lack of Discipline

Lumpsum investments don’t encourage regular saving habits, as they rely on a one-time commitment. This can lead to overspending or irregular investing.

Comparison Between SIP and Lumpsum

To make an informed decision, let’s compare SIP vs Lumpsum Investment based on key factors:

| Aspect | SIP | Lumpsum |

|---|---|---|

| Investment Amount | Small, fixed amounts (e.g., Rs. 100/month) | Large, one-time investment (e.g., Rs. 10,000+) |

| Market Timing | Spreads risk across market cycles | Requires timing the market correctly |

| Risk Tolerance | Lower risk due to rupee cost averaging | Higher risk if market declines post-investment |

| Time Horizon | Ideal for long-term goals (e.g., 5–10 years) | Suitable for short-term or medium-term goals |

| Discipline | Encourages regular saving and investing | No built-in discipline |

| Flexibility | Can pause, stop, or increase contributions | No flexibility post-investment |

| Entry Barrier | Low (as low as Rs. 100/month) | High (requires substantial capital) |

| Potential Returns | Consistent returns over time | Higher returns possible if timed well |

| Compounding | Benefits from regular reinvestment | Limited compounding compared to SIP |

| Suitability | Beginners, risk-averse, long-term goals | Experienced investors, high risk tolerance |

Example Scenario

SIP Example: Priya, a 30-year-old salaried professional, starts an SIP of Rs. 5,000 per month in an equity mutual fund with an expected annual return of 12%. Over 10 years, she invests Rs. 6 lakh (5,000 x 12 x 10). Using a SIP calculator, her investment could grow to approximately Rs. 11.6 lakh, thanks to compounding and rupee cost averaging.

Lumpsum Example: Raj, a 40-year-old businessman, invests Rs. 6 lakh in the same fund when the market is low. If the market grows at 12% annually, his investment could grow to Rs. 18.6 lakh in 10 years. However, if he invests at a market peak and it corrects by 20%, his investment could drop to Rs. 4.8 lakh initially, requiring time to recover.

This illustrates that SIPs offer stability, while lumpsum can yield higher returns or losses depending on timing.

When to Choose SIP Over Lumpsum

SIPs are generally recommended for:

- Limited Funds: If you can only invest small amounts regularly, SIPs are ideal. For example, a young professional earning Rs. 30,000 monthly can start with Rs. 1,000 per month.

- Risk-Averse Investors: SIPs reduce the impact of market volatility through rupee cost averaging, making them suitable for those who prefer lower risk.

- Long-Term Goals: SIPs are perfect for goals like retirement, child’s education, or wealth creation over 5–20 years.

- Beginners: If you’re new to investing, SIPs allow you to start small and learn without risking a large sum.

- Irregular Income: Freelancers or those with variable income can adjust SIP amounts or pause them as needed.

- Disciplined Investing: SIPs foster a habit of regular saving, ideal for salaried individuals or retirees.

When to Choose Lumpsum Over SIP

Lumpsum investments are better suited for:

- Large Capital Availability: If you receive a windfall, like a bonus, inheritance, or sale proceeds, lumpsum allows you to deploy it immediately.

- Favorable Market Conditions: If you believe the market is at a low point (e.g., during a correction), lumpsum can maximize returns.

- Short-Term Goals: For goals like buying a car in 2–3 years, lumpsum can be more effective if timed well.

- High Risk Tolerance: Experienced investors comfortable with market fluctuations can opt for lumpsum to capitalize on market opportunities.

- Retirement Corpus or Estate Planning: Lumpsum can be used to build a retirement fund or plan for legacy if you have significant savings.

Performance Insights

While specific academic studies comparing SIP and lumpsum returns in India are limited, industry data provides insights. According to the Association of Mutual Funds in India (AMFI), SIP contributions crossed Rs. 23,000 crore in August 2024, reflecting their popularity. A 2017 Economic Times article noted that SIPs in top-performing funds like Motilal Oswal MOSt Focused Multicap 35 Fund yielded 25.18% annual returns over three years, compared to 28.77% for lumpsum in the same fund. However, SIPs offered lower risk due to cost averaging.

In a rising market, lumpsum investments may outperform SIPs, as seen post-COVID-19 when markets surged. Conversely, in volatile or falling markets, SIPs tend to perform better by accumulating more units at lower prices. Over the long term, SIPs often provide more consistent returns due to compounding and disciplined investing.

Tax Implications

- SIP: Investments in ELSS funds via SIP qualify for tax deductions under Section 80C (up to Rs. 1.5 lakh annually). Long-term capital gains (LTCG) from equity funds are taxed at 12.5% for gains above Rs. 1.25 lakh per year.

- Lumpsum: Similar tax rules apply, but since the entire amount is invested at once, the tax liability may arise sooner if you redeem early. Consult a tax advisor to understand implications based on your investment horizon.

FAQs

Is SIP better than lumpsum for long-term investments?

SIPs are generally better for long-term investments due to rupee cost averaging and compounding, which reduce risk and ensure consistent growth. They’re ideal for goals like retirement or education.

Can I switch from SIP to lumpsum or vice versa?

Yes, most mutual fund houses allow switching between SIP and lumpsum. You can stop an SIP and invest a lumpsum in the same or different scheme, subject to fund rules.

Which one has higher returns, SIP or lumpsum?

It depends on market conditions. Lumpsum can yield higher returns in a rising market if timed correctly, but SIPs offer more consistent returns over time due to cost averaging.

Is there a minimum amount required for SIP?

Yes, the minimum amount is typically Rs. 100 per month, though some funds may require Rs. 500 or more, depending on the scheme.

Can I invest in both SIP and lumpsum simultaneously?

Yes, you can use SIP for long-term goals and lumpsum for short-term opportunities or when you have surplus funds. This hybrid approach diversifies your strategy.

What happens if I miss an SIP payment?

Missing an SIP payment doesn’t affect existing investments, but you miss purchasing units for that period. Most funds allow you to resume without penalties.

Are SIPs tax-efficient?

Yes, SIPs in ELSS funds offer tax deductions under Section 80C (up to Rs. 1.5 lakh annually). LTCG from equity funds is taxed at 12.5% for gains above Rs. 1.25 lakh.

Can I withdraw from an SIP early?

Yes, you can withdraw from an SIP anytime, but check for exit loads (fees for early withdrawal). Early withdrawal may disrupt long-term goals.

How do I choose between SIP and lumpsum?

Consider your financial goals, risk tolerance, and investment horizon. SIPs suit risk-averse investors and long-term goals, while lumpsum is better for those with large capital and market timing skills.

Is SIP suitable for retirees?

Yes, SIPs can be suitable for retirees seeking disciplined investing with low risk. They can invest small amounts regularly to generate steady returns.

Conclusion

Choosing between SIP vs Lumpsum Investment depends on your financial situation, goals, and risk appetite. SIPs are ideal for most Indian investors, especially beginners, due to their low entry barrier, disciplined approach, and risk mitigation through rupee cost averaging. They’re perfect for long-term goals like retirement or wealth creation. Lumpsum investments, however, can be advantageous for those with significant capital, market knowledge, and a willingness to take risks, particularly for short-term goals or market opportunities.

Many investors use a combination of both strategies—SIPs for regular investing and lumpsum for windfalls or market dips. The key is to start early, stay consistent, and review your investments periodically. Consulting a financial advisor can help tailor your strategy to your unique needs.

Disclaimer: Moneyjack.in provides general financial information for educational purposes only. We are not financial advisors. Content is not personalized advice. Consult a qualified professional before making financial decisions. We are not liable for any losses or damages arising from the use of our content. Always conduct your own research.