Hey there! If you’re reading this, chances are you’ve got a term insurance policy, or maybe you’re helping a loved one navigate through a tough time. Losing someone close is never easy, and dealing with insurance claims can feel overwhelming on top of that. But don’t worry—I’m here to walk you through how to file a term insurance claim in India step by step. We’ll keep things simple, straightforward, and in a way that feels like we’re chatting over a cup of chai. This guide is all about making the process less stressful so you can focus on what really matters.

Term insurance is one of the most popular types of life insurance in India because it’s affordable and provides pure protection. But when the time comes to claim it, knowing how to file a term insurance claim correctly can make all the difference. In this article, we’ll cover everything from the basics to the nitty-gritty details, ensuring you’re well-prepared. By the end, you’ll feel confident about how to file a term insurance claim without running into common pitfalls.

Table of Contents

Understanding Term Insurance: The Foundation Before Learning How to File a Term Insurance Claim

Before we get into how to file a term insurance claim, let’s make sure we’re on the same page about what term insurance actually is. Imagine term insurance as a safety net for your family. It’s a type of life insurance that promises to pay a lump sum amount (called the sum assured) to your nominees if something unfortunate happens to you during the policy term. Unlike other insurances that might have investment components, term plans are straightforward—no maturity benefits if you outlive the term, just pure protection.

In India, companies like LIC, HDFC Life, ICICI Prudential, and SBI Life offer term insurance plans. These are super popular because premiums are low—think of paying just a few thousand rupees a year for coverage worth crores. But here’s the catch: the claim only kicks in if the policyholder passes away during the active period. That’s why knowing how to file a term insurance claim is crucial for beneficiaries.

Why does this matter? Well, according to IRDAI data, millions of Indians buy term insurance every year, but claim settlement ratios hover around 98-99% for top insurers. That means most claims get approved, but the ones that don’t often fail due to paperwork errors or delays. So, arming yourself with knowledge on how to file a term insurance claim can boost your chances of a smooth payout.

Let me share a quick story. My friend Raj from Mumbai had a term policy with Max Life. When his father passed away unexpectedly, the family was in shock. But because Raj had read up on how to file a term insurance claim, they gathered documents quickly and got the claim settled in under a month. It wasn’t just about the money—it gave them closure during a hard time.

Why Filing a Term Insurance Claim Properly is a Big Deal in India

Now, you might be thinking, “Why all the fuss about how to file a term insurance claim?” Fair question. In India, life insurance claims aren’t just about filling a form; they’re governed by strict regulations to prevent fraud and ensure fairness. If you mess up, your claim could be delayed or rejected, leaving your family in financial limbo.

For instance, the IRDAI mandates that insurers settle claims within 30 days if no investigation is needed, but that clock starts only when all documents are submitted correctly. Delays can stretch to 90 days or more if there’s scrutiny. And in a country where many families rely on these payouts for debts, education, or daily expenses, timing is everything.

Plus, term insurance claims are death claims by nature, so emotions run high. Knowing how to file a term insurance claim helps you stay organized and avoid adding stress. It’s like having a roadmap during a storm— it guides you safely to the other side.

Statistics show that claim rejections often stem from non-disclosure of health issues at policy purchase or incomplete forms. By understanding how to file a term insurance claim, you can sidestep these traps. In the next sections, we’ll break it down further.

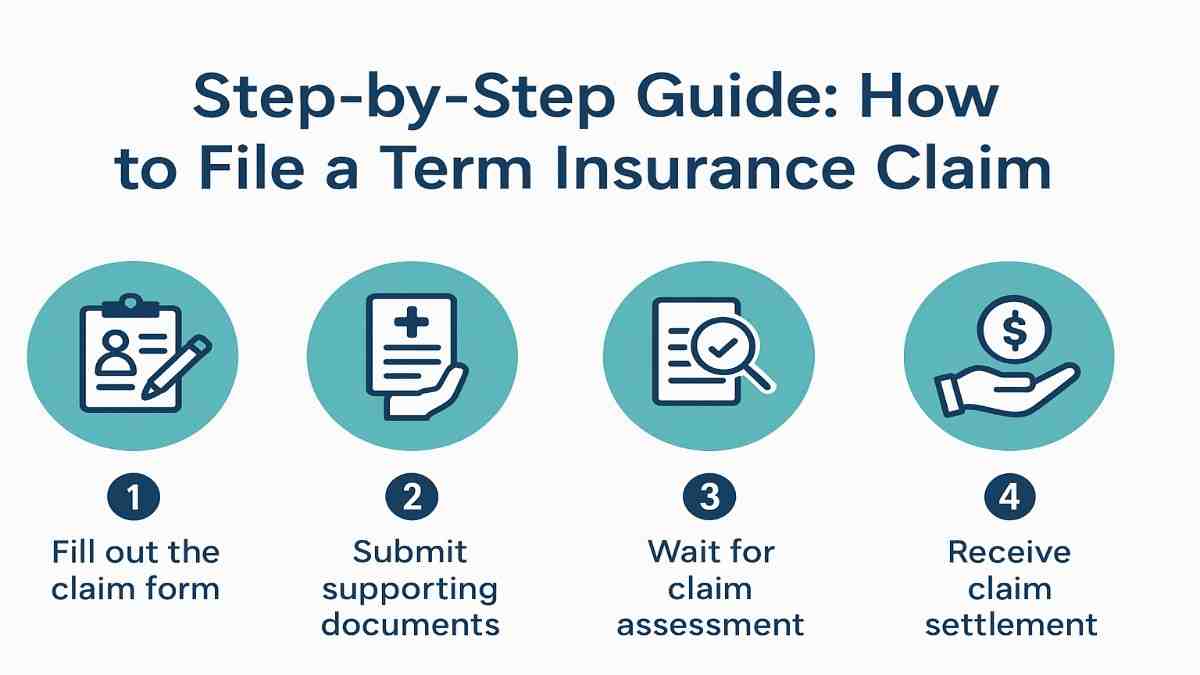

Step-by-Step Guide: How to File a Term Insurance Claim in India

Alright, let’s get to the heart of it—how to file a term insurance claim in simple steps. I’ll explain each one like I’m guiding a friend through it. This process applies to most insurers in India, but always check your policy document for specifics.

Step 1: Intimate the Claim as Soon as Possible

The first thing in how to file a term insurance claim is notifying the insurance company about the policyholder’s death. This is called claim intimation. In India, you can do this online via the insurer’s website, app, or by calling their helpline. Some even allow SMS or email notifications.

Why hurry? IRDAI rules say you should inform within a reasonable time, but ideally within 30-90 days, depending on the insurer. Delaying can raise red flags. For example, if it’s LIC, head to their nearest branch or use the e-services portal.

Gather basic info like policy number, deceased’s name, date and cause of death, and your details as the nominee. Once intimated, the insurer will assign a claim reference number—keep it handy for tracking.

Step 2: Gather All Required Documents

Documents are the backbone of how to file a term insurance claim. Without them, nothing moves. Start collecting right after intimation.

Key documents include:

- Original policy document or a duplicate if lost (insurers can issue one).

- Death certificate from the municipal corporation or hospital.

- Claim form filled by the nominee (download from insurer’s site).

- ID proofs of nominee and deceased (Aadhaar, PAN, passport).

- Bank details for payout (canceled cheque).

If the death was due to accident or illness, add FIR, post-mortem report, or medical records.

In India, for natural deaths, it’s simpler, but unnatural ones need more scrutiny. Pro tip: Make photocopies of everything and keep originals safe.

Step 3: Submit the Claim Form and Documents

Next in how to file a term insurance claim is submission. You can do this online (upload scans), at a branch, or via post. Insurers like Tata AIA or Bajaj Allianz have user-friendly portals for this.

Fill the form carefully—any mismatch in details can cause delays. Attach all docs and submit. The insurer will acknowledge receipt and start processing.

Step 4: Wait for Verification and Investigation

After submission, the insurer verifies everything. For straightforward cases, it’s quick. But if the policy is new (within 3 years), or death is suspicious, they might investigate. This could involve home visits or medical checks.

In India, IRDAI ensures transparency, so you’ll get updates. Patience is key here—it’s part of how to file a term insurance claim smoothly.

Step 5: Receive the Payout

Once approved, the sum assured is paid via NEFT or cheque. Track status online using the reference number.

If rejected, you’ll get reasons in writing. You can appeal to the insurer or IRDAI ombudsman.

That’s the core of how to file a term insurance claim. Sounds doable, right? Now, let’s expand on documents because they’re often the tricky part.

Documents Required for How to File a Term Insurance Claim: A Detailed Breakdown

When it comes to how to file a term insurance claim, documents can make or break it. Let’s go deeper.

First, the death certificate. Issued by the registrar of births and deaths, it must state the cause. If abroad, get it attested by the Indian embassy.

Then, the claim form. It’s usually two parts—one for basic info, another for medical details if needed.

ID proofs: Aadhaar is mandatory now for KYC in India. Include voter ID or driving license if extra verification is required.

For bank details, ensure the account is in the nominee’s name.

Additional docs for specific cases:

- Accident: Police FIR, panchnama, driving license if road accident.

- Illness: Hospital discharge summary, doctor’s certificate.

- Suicide (after 1 year of policy): Still payable, but needs police report.

Lost policy? File an FIR and get a duplicate from the insurer.

Organizing these early is a smart move in how to file a term insurance claim.

Timelines and What to Expect When Learning How to File a Term Insurance Claim

Timelines are critical in how to file a term insurance claim. IRDAI says:

- Intimation: As soon as possible.

- Submission: Within 90 days of death, but extensions possible.

- Settlement: 30 days for non-investigation cases, 90 for others.

In practice, top insurers like HDFC Life settle 99% within days if docs are perfect.

Factors affecting time: Policy age, claim amount (high sums get more checks), cause of death.

If delayed, follow up politely. Use IRDAI’s grievance portal if needed.

Common Mistakes to Avoid in How to File a Term Insurance Claim

Even with a guide on how to file a term insurance claim, mistakes happen. Here’s what to watch out for.

- Delaying intimation: Don’t wait—notify immediately.

- Incomplete forms: Double-check spellings, dates.

- Wrong nominee details: Ensure policy nominees are updated.

- Non-disclosure: If health issues were hidden at purchase, claim could be denied.

- Ignoring follow-ups: Respond quickly to insurer queries.

A real example: A family in Delhi lost their claim because the death certificate had a typo. Fixed it, but delayed payout by months.

By avoiding these, your how to file a term insurance claim process will be smoother.

Tips from Experts on How to File a Term Insurance Claim Successfully

Want insider tips for how to file a term insurance claim? Here goes.

- Buy from reputable insurers with high claim ratios (check IRDAI reports).

- Keep policy docs digital and physical.

- Inform family about the policy.

- Use online tools—apps like Policybazaar can help track.

- Consult an advisor if stuck.

In India, with digital India push, many claims are paperless now.

Special Cases in How to File a Term Insurance Claim

Sometimes, how to file a term insurance claim has twists.

- If nominee is minor: Guardian appoints.

- Multiple policies: File separately.

- Overseas death: Attest docs.

- Rider claims (e.g., critical illness): Separate form.

Handle these carefully.

The Role of IRDAI in How to File a Term Insurance Claim

IRDAI protects you in how to file a term insurance claim. They ensure fair practices, mandate disclosures, and offer grievance redressal.

If unhappy, approach insurer first, then ombudsman, then court.

Emotional Aspects of How to File a Term Insurance Claim

Beyond steps, how to file a term insurance claim involves emotions. Grieve, but act timely. Seek support from family or counselors.

Stories from forums like Reddit show how preparation helps healing.

Choosing the Right Term Insurance to Ease How to File a Term Insurance Claim Later

Prevention is better—pick plans with easy claim processes. Look for online submission, high ratios.

Compare on sites like BankBazaar.

Future of Term Insurance Claims in India

With tech, how to file a term insurance claim is getting faster—AI verification, blockchain for docs.

IRDAI pushes for 100% digital by 2025.

Conclusion: Mastering How to File a Term Insurance Claim

We’ve covered a lot on how to file a term insurance claim in India. From steps to tips, you’re now equipped. Remember, it’s about protecting your loved ones—stay informed, act promptly.

FAQ:-

What is the first step in how to file a term insurance claim?

The first step is to intimate the insurance company about the death as soon as possible, ideally within days.

How long does it take to settle a term insurance claim in India?

Typically 30 days for simple cases, up to 90 if investigation is needed, per IRDAI rules.

Can a term insurance claim be rejected?

Yes, for reasons like fraud, non-disclosure, or incomplete docs, but most are approved if genuine.

What if the policy document is lost?

File for a duplicate with the insurer by submitting an affidavit and FIR if necessary.

Is there a time limit for filing a term insurance claim?

No strict limit, but delay beyond 90 days may complicate things—act quickly.

How can I track my term insurance claim status?

Use the insurer’s website or app with the claim reference number.

What documents are needed for accidental death in term insurance claim?

FIR, post-mortem report, plus standard docs like death certificate.

Disclaimer

CryptoStockHub provides information for educational purposes only, not financial or investment advice. I am not a financial advisor. Content, including market analyses and predictions, is not professional guidance. Investing in cryptocurrencies and stocks involves high risks, including potential loss of principal due to market volatility or regulatory changes. Data is sourced from public information as of July 10, 2025, and may change. Conduct your own research and consult a qualified financial advisor before investing. CryptoStockHub is not liable for losses from using this information. Verify external sources independently.